- Application Services

- Next-Gen App Development

- Mobile Application Development

- Modernization

-

-

- Integration ServicesGet seamless integration of various 3rd party services or existing systems for smooth operations of your mobile apps

- Cross PlatformsExcellent user experience and functionality of native apps with multi-platform compatibility

- Legacy System Modernization ServicesLegacy system modernization empowers organizations so that they can work more efficiently and intelligently.

-

-

- DevOps

- Software Testing

-

-

- AI Enabled TestingLeverage AI for testing the quality of your software products

- Functional TestingAutomated Functional Testing for improved quality & faster go-to-market

- STQC CertificationQuality, Excellence, and Innovation – The Hallmarks of Suma Soft

- Performance TestingEliminate performance bottlenecks of business-critical apps to run under expected, peak loads

-

- Scriptless Automation SolutionsFast, reliable, and easy testing with our “Ready-to-Deploy” automation framework

- Devops TestingOptimize testing in CI/CD pipelines for greater agility, efficiency, and quality

- AA CertificationEmpaneled Certifier for Account Aggregator (AA) Ecosystem

- ABDM Ecosystem Sandbox Exit ProcessWe Certify Your API for ABDM Sandbox Integration And Exit Process

-

-

- AI/ML Services

- AI/ML ServicesStay ahead of the curve with our advanced AI/ML capabilities

- Data Engineering ServicesDrive data-driven decision-making with our agile and customizable data engineering solutions

- Software Product Engineering ServicesTransform your concepts into market-leading products with our strategic product engineering approach

- VaniePartner with Us for Innovative Web App Solutions!

- Indiastack

- Account AggregatorGet certified using Daksh DEPA Validator to go live on the AA network.

- Ayushman Bharat Digital Mission (ABDM)Get certified using Daksh DEPA Validator to go live on the ABDM network.

- Beckn Protocol ImplementationImplement Beckn protocol to go live on India Stack network.

- ONDC CertificationGet certified using Daksh DEPA Validator to go live on the ONDC network.

- O Rickshaw Pune’s First ONDC Mobility App

- Business Services

- Business Process Management

-

-

- Healthcare BPO ServicesRound the clock coverage for most critical industry

- Logistics BPO & Supply Chain ManagementSmarter supply chains Built for today and ready for tomorrow

- Data Entry ServicesEnsure the accuracy and security of your data with Suma Soft

- Underwriting support servicesStreamline underwriting processes , increase accuracy, reduce risk with expert support services.

- Finance and Accounting ManagementImproving Account Payable and Receivables Through Artificial Intelligence

-

- Logistics BPO ServiceOptimize logistics with efficient operations, reduced costs, and our improved visibility.

- Customer Support ServicesSmart use of technology makes all the difference in CX

- REIT Management ServicesProductivity for You. Transparency for Your Investor

- OCR Outsourcing ServicesAchieve faster, accurate and reliable data capture with OCR outsourcing solutions.

- Claims ManagementState-of-the-art technology to assist in responding to rapidly-evolving claim situations

-

-

- Tech Support

-

-

- Desktop SupportResponsive, Day-to-Day Tech Assistance

- Network SupportCreate a comprehensive network security strategy for protecting the enterprise end-to-end

- Active Directory SupportMinimize the risk of disrupting critical business apps while optimizing the performance of MS infrastructure

- Microsoft Exchange SupportStay on top of imminent threats to achieve a glitch-free network with rapid Microsoft Exchange support

-

- L1 & L2 SupportOptimize performance with round-the-clock technical support cater to your business goals

- Remote MonitoringKeep your IT systems running smoothly and ensure the stability and security of your IT environment for the workforce

- NOCGet unrivaled NOC services & scale immediately to enhance your bottom-line profitability with 24*7 services

-

-

- Hyperautomation

-

- Cyber Security

-

-

- AssessmentTest your applications and networks to identify & fix vulnerabilities exposing your sensitive assets

- Cloud SecurityIntelligence and expertise providing a new level of cyber-immunity

- Managed SecurityComprehensive security architecture with flexible enforcement for advanced protection

- Digital ForensicsEmpower your organization to access, manage and leverage Digital Data

-

-

- ServiceNow

- ServiceNow Managed ServicesOngoing ServiceNow support and optimization for peak performance.

- ServiceNow Integration ServicesOngoing ServiceNow Integration Services

- ServiceNow Implementation ServicesExpert ServiceNow implementation for customizable business solutions.

- ServiceNow Migration ServiceAchieve seamless platform transitions with smooth ServiceNow migration.

- ServiceNow Consulting ServicesStrategic ServiceNow consulting for optimal platform utilization.

- ServiceNow ITBM ImplementationImplement ITBM for strategic IT planning and execution.

- ServiceNow ITSM Implementation ServicesPlan and streamline IT service management with expert implementation services.

- ServiceNow Chatbot DevelopmentEnhance user experience with intelligent ServiceNow chatbot solutions.

- ServiceNow CSM ImplementationImprove customer service with efficient ServiceNow CSM implementation.

- ServiceNow GRC ImplementationManage governance, risk, and compliance with ServiceNow GRC.

- ServiceNow Security OperationsStrengthen security posture with ServiceNow security operations management.

- ServiceNow IT Operations Management ServicesOptimize Your IT Operations with automated workflows and efficient service delivery.

- ServiceNow HR Service DeliveryEnhance employee experiences with automated HR service management.

- ServiceNow Financial ManagementStreamline financial operations and improve decision-making with ServiceNow.

- ServiceNow Asset Management ServicesControl IT assets, reduce costs, and ensure compliance with ServiceNow Asset Management.

- Project Portfolio Management ServiceNowPrioritize projects and manage resources for successful delivery.

- Resource Management with ServiceNowStreamline resource allocation for project efficiency and success with ServiceNow Resource Management.

- Business Process Management

- Digital

- Cloud

-

-

- Cloud App Development ServicesGet high security, efficient performance, and excellent operations with cloud apps

- Cloud Testing ServicesDelivering highly polished solutions to help you reduce costs and meet deadlines

- Cloud Migration ServicesA secure cloud single sign-on solution that IT, security, and users will surely love

-

- Enterprise Mobility

- CRM

- Microsoft Dynamics 365 ServicesStreamline business processes with superior BI, automation, and key customer insights

- Custom CRM Development ServicesDigitize processes, enhance everyday managerial activities and engage more customers

- Salesforce Consulting ServicesTransform Your Business with Expert Salesforce Guidance – Elevate Performance and Drive Growth!

- Salesforce testing servicesAchieve end-to-end automation for Salesforce testing

- E-Learning

- Collaboration

- Dusmile Platform

- Cloud

- Insights

- Industries

- Industry We Serve

- Banking And FinanceAccelerate your journey with fintech innovation to reshape customer experience

- GovernmentFully-managed environment for Government, Built for security and compliance

- E-CommerceBest-of-breed technologies to enhance CX and increase revenue to maximize business needs

- E-LearningReimaging education – from remote to hybrid learning

- Logistics & DistributionChanging the landscape of supply chain management

- AutomotiveRevolutionizing automotive development for the digital future

- HealthcareDelivering better experiences, better insights, and better care for better health

- ManufacturingLeverage our deep expertise to modernize your manufacturing and industrial technologies and processes.

- Industry We Serve

- About Us

- About Suma Soft

- HistoryDecades of experience and expertise matched with dedicated professionals.

- LeadershipA leadership that drives Suma Soft to meet its overall goals.

- CertificationsOur recognition as a trusted technology company for orchestrating a successful business transformation

- Our PartnersBringing together the best technologies and practices to offer a prosperous digital future

- Annual ReturnSuma Soft’s Yearly Financial Annual Return Report

- About Suma Soft

- Careers

- Contact Us

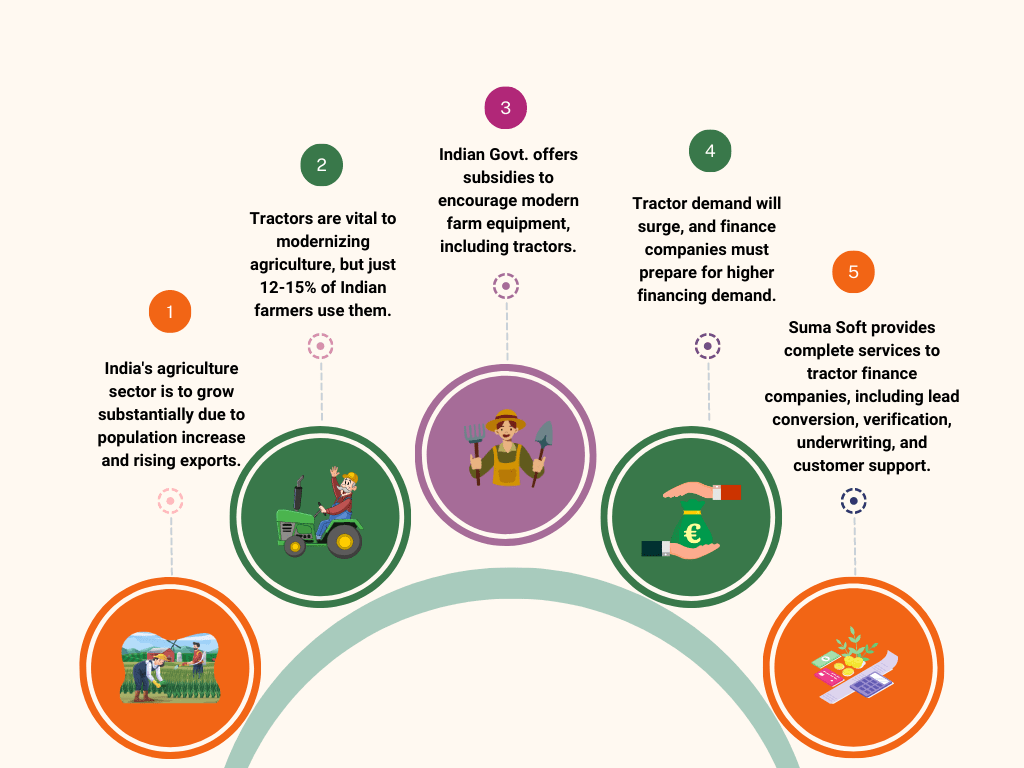

With a population of 140 Crores, India is the second most populous nation in the world. As per estimates, India’s population is expected to reach 150 Crores by 2030.

Another important statistic to be reviewed is export revenue of India’s agricultural products. India’s agricultural exports were at Rs. 20,00,000 Crore in 2020. It is expected to reach Rs. 30,00,000 Crore in year 2030.

Both above numbers point to an important conclusion: India’s agricultural growth is unavoidable and is going to be substantial in coming years.

To support requirements of growing population within India and across the globe, it is important for Indian agricultural sector to gear up for this challenge and make advancements in ways in which farming is being done. This includes modernization of ways of cultivation and using emerging technologies to achieve better results as compared to traditional ways of agriculture.

Indian’s have traditionally been using manual labour or cattle to cultivate their farmlands. This was a very time-consuming process. With advent of vehicles, progressive farmers brought in the change and started using Tractors for cultivation and it provided great results. While over 9 lac tractors were sold in India during the year 2021-22, overall, the percentage of farmers using tractors is only about 12 to 15%. As compared to overall agricultural market, the number is substantially low.

This has been realized by government and to promote adoption of contemporary tools and modern methods to achieve farm mechanization, many state governments and the central government have offered subsidies in the range of 25% to 50% on purchase of tractors. The India Agricultural Tractor Market is expected to experience a compound annual growth rate of 8.9% from 2023 to 2027.

On an average, only about 15-18% farmers in India are wealthy enough to afford purchasing of modern farm equipment. Remaining 80%+ farmers are dependent on financial assistance by banks to purchase tractors.

Considering the potential of growth of demand for farm equipment and especially tractors, the vehicle manufacturing companies, and vehicle finance companies need to gear up for this herculean challenge.

Vehicle finance companies may be able to make provisions for funds as needed, however it is important for them to be administratively ready to handle the inflow of applications and processing of those on an expedited manner as competition in this market is going to grow quite fast. Those who can take advantage of strategies such as quicker staff augmentation, outsourcing, partnerships may be able to take advantage of this tsunami requirement of agriculture sector.

We at Suma Soft have domain expertise to provide end to end services to Tractor Finance industry. Our portfolio of services includes Lead Conversion, Verifications, CPA processing, Underwriting, Disbursement Processing, Post Disbursement Documentation and Customer Servicing.

Suma Soft aspires to be a strong partner with Tractor finance companies as the industry goes through this demanding period.

Recent Posts

- DevOps in Software Product Engineering: Streamlining Development and Operations September 10, 2024

- Accelerate Your Business with Our Data Engineering Solutions: A Case Study August 20, 2024

- The Role of Cloud Computing in Modern Data Engineering Solutions June 25, 2024

- Why 70% of Enterprises Are Choosing Hybrid Apps and How They Benefit May 24, 2024

- How Building a Native App Can Increase Customer Engagement by 3X May 20, 2024

- What Competitive Advantages Do PWAs Offer Over Traditional Mobile Apps? May 16, 2024

- 5 Must-Have Features for Enterprise-Level iOS Apps May 14, 2024

- 5 Ways to Supercharge Your Android App with AI and Machine Learning May 8, 2024

- Comparing Traditional ETL vs. Modern Data Engineering Approaches April 24, 2024

- Can Outsourcing E-Commerce Customer Service Actually Drive Sales and Brand Loyalty? April 10, 2024